Pan European Open Banking Hub

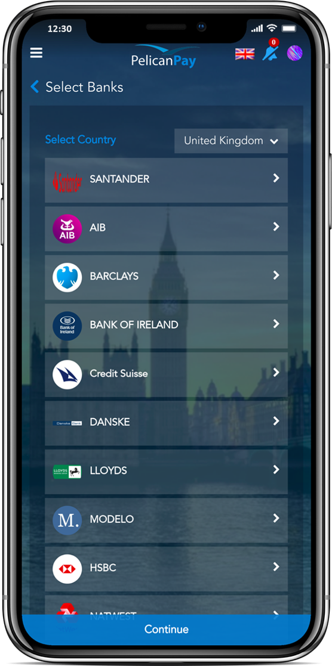

Welcome to the OneLinQ API portal, a complete platform to connect to many banks across Europe with a single unified API interface.

Here, you will find all the necessary resources to enable you to innovate and create awesome apps.

Today OneLinQ offers out-of-the-box connectivity to many banks in Europe via 1 single API.

Since OneLinQ is natively connected to the PSD2 APIs of the banks, It gives you the full PSD2-experience without any sacrifices.

The OneLinQ interoperability platform also supports the other popular standards such as UK OBWG, The Berlin Group NextGenPSD2 and STET.

How to get started?

Sign-up

Sign up now to create an account and get started. It is free to join.

Register

Register your application to get your API credentials.

Get Connected

Connect to our sandbox and start testing.

About OneLinQ

OneLinQ is an innovative payments and financial crime compliance platform for fintechs and Third Party Providers (TPPs), providing easy onboarding and a streamlined global payments process. OneLinQ provides PSD2 Payment Initiation and Account Information services, accessible to all organisations seeking a truly pan-European and interoperable payment gateway solution.

OneLinQ is constantly adding new banks to the platform making it a sustainable solution for now and in the future. With more than 20+ years of experience in payments, OneLinQ is your Open Banking partner.

Our Solutions

PSD2 integration

The OneLinQ OpenBanking Hub enables access to pan-European PSD2 Payment Initiation and Account information solutions for fintechs looking to leverage the enormous growth opportunities provided in an OpenBanking environment.

It enables innovative financial technology companies to focus on delivering their core service proposition to customers, while OneLinQ platform takes care of all the technical and regulatory complexity of API connectivity to your customers' bank accounts