Affordability Check

Summary

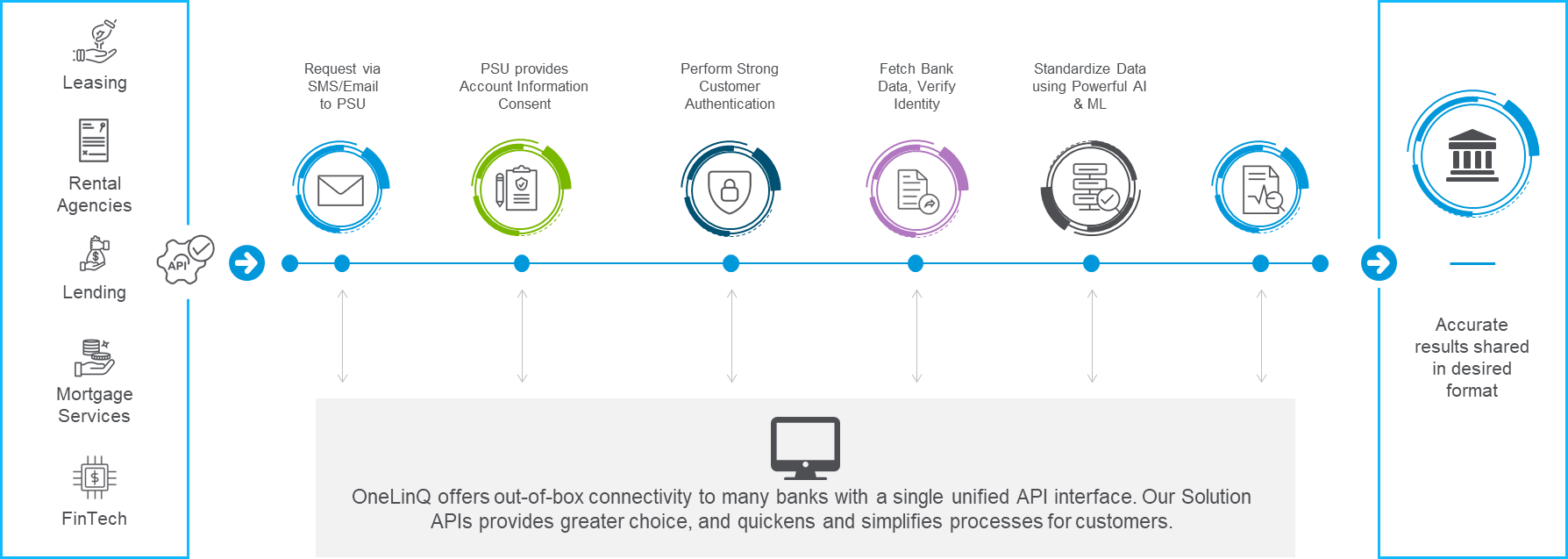

OneLinQ Affordability Check uses powerful AI and machine learning to analyze bank data and get a deeper understanding of customers’ income & expense records. As a result, the partners can dramatically reduce credit risk by having an instant accurate snapshot of a customer’s financial history and using them to make informed credit decisions.

Key Features

1. Secure data access

2. Real-time Affordability Check

3. Customizable Affordability Check

4. Results in JSON/PDF

5. Compliance with regulations

6. REST API Integration

7. White Labelling support

8. Multilanguage support

Affordability Check APIs

API Name | API Endpoint | API Description |

Fetch Consent for Accounts | POST /accountconsent | The Consent API will be used to fetch consent for all required accounts. |

| Get Report Status | GET /reportstatus/{reportId} | An API to get the report status |

| Get Report Details | GET /bankData/{reportId} | An API to get balance information for all accounts consented by user via PSD2 path. |

Affordability Check Flow Diagram

Affordability Check Steps

Step 1: Affordability Request Request

Partner / Customer sends the Affordability Check request. Post authentication the request will be accepted in OneLinQ.

In case the flow type is REDIRECT, the end user will be redirected to the Affordability Check Page to review Account details.

In case the flow type is REQUEST, OneLinQ will send the Affordability Check Link via the preferred mode (Email/SMS). The end user will be redirected to the Affordability Check Consent Page to review Account details.

The Partner/Customer receives a report ID, redirection URL, and consent ID (through Inline API response/Email/SMS).

Step 2: AIS Consent

On the Affordability Check Consent Page, the end user provides the AIS consent Bankwise to OneLinQ.

Step 3: Authorize AIS Consent

The end user will securely authorize the consent using the Strong Customer Authentication Method. (OneLinQ supports SCA through Authentication Embedded, Re-direct, and De-coupled.)

Step 4: Fetch Account Details

On successful consent authorization, OneLinQ consumes the PSD2 or Open Banking API of the bank and asks for the Account, Balance, and transaction details for analysis. (Note if Account Holder Verification Check is applicable, then the Account Details fetched from the bank will be used to validate the Account Number, the Account Holder name, Account Active status, and Name matching will be done. In case of failure, the Partner/Customer cannot call for Affordability Check status.)

Step 5: Get Report Status

The response of this API will provide the status of the Affordability Check report.

Additionally, once the report is generated, the webhook will notify the status to the Partner/Customer.

Step 6: Get Report

The response of this API will provide the Affordability Check report data.