Income Expense Analysis

Summary

OneLinQ Income Expense Analysis uses powerful AI and machine learning to analyze the customer’s bank statements and get a deeper and more accurate understanding of how the money is spent & income is earned. As a result, the partner can increase engagement with real-time & historical financial data to provide actionable advice on financial products.

Key Features

1. Learn API (Personalization)

2. Secure data access

3. Real-time Income Expense Analysis

4. Income Expense Analysis

5. Compliance with regulations

6. REST API Integration

7. White Labelling support

8. Multilanguage support

Income Expense Analysis APIs

API Name | API Endpoint | API Description |

Income Expense Analysis API | POST /initiate-report | API to initiate fetching the report |

Income Expense Analysis API | GET /{reportId}/status | API to get the status of the specific report ID |

Income Expense Analysis API | GET /{reportId}/report | API to get the report of the specific report ID |

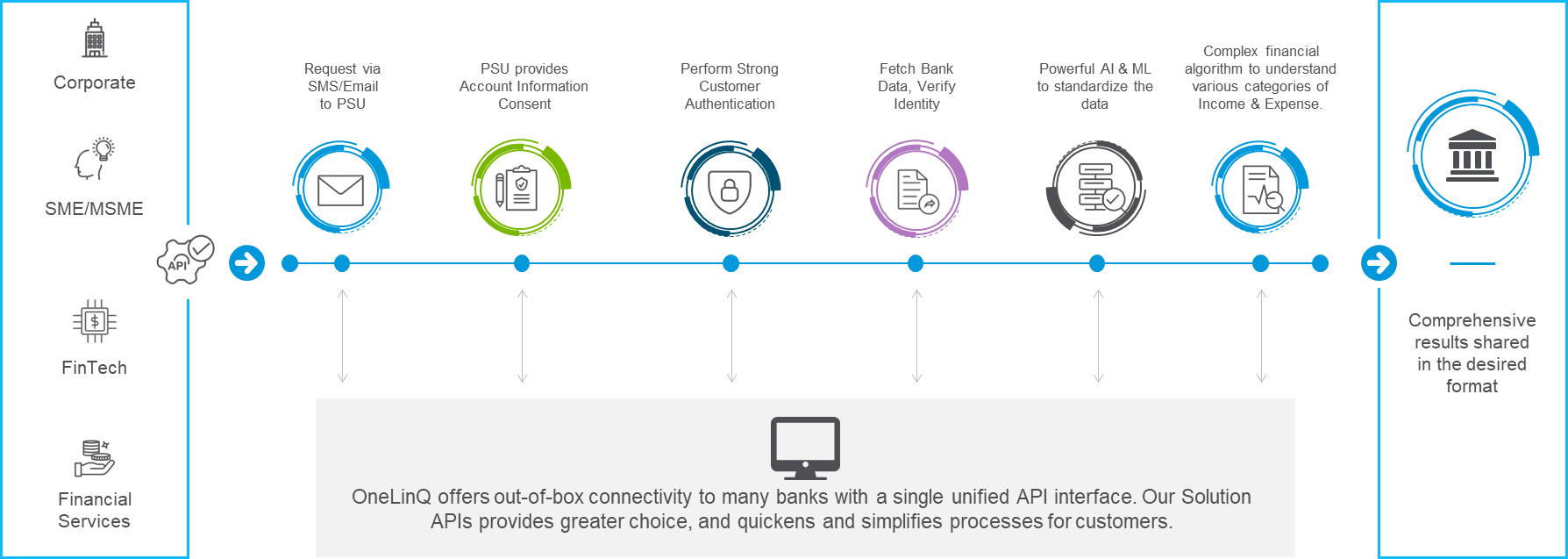

Income Expense Analysis Flow Diagram

Income Expense Analysis Steps

Step 1: Income Expense Analysis Request

Partner / Customer sends the Income Expense Analysis request. Post authentication the request will be accepted in OneLinQ.

In case the flow type is REDIRECT, the end user will be redirected to the Income Expense Analysis Page to review Account details.

In case the flow type is REQUEST, OneLinQ will send the Income Expense Analysis Link via the preferred mode (Email/SMS). The end user will be redirected to the Income Expense Analysis Consent Page to review Account details.

The Partner/Customer receives a report ID, redirection URL, and consent ID (through Inline API response/Email/SMS).

Step 2: AIS Consent

On the Income Expense Analysis Consent Page, the end user provides the AIS consent Bankwise to OneLinQ.

Step 3: Authorize AIS Consent

The end user will securely authorize the consent using the Strong Customer Authentication Method. (OneLinQ supports SCA through Authentication Embedded, Re-direct, and De-coupled.)

Step 4: Fetch Account Details

On successful consent authorization, OneLinQ consumes the PSD2 or Open Banking API of the bank and asks for the Account, Balance and transaction details for analysis. (Note if Account Holder Verification Check is applicable, then the Account Details fetched from the bank will be used to validate the Account Number, the Account Holder name, Account Active status, and Name matching will be done. In case of failure, the Partner/Customer cannot call for Income Expense Analysis status.)

Step 5: Get Report Status

The response of this API will provide the status of the Income Expense Analysis report.

Additionally, once the report is generated, the webhook will notify the status to the Partner/Customer.

Step 6: Get Report

The response of this API will provide the Income Expense Analysis report data.