Verification of Payee

Summary

Verification of Payee assures the Payer that the payment is sent to the intended payee, thereby reducing the risk of fraudulent transactions and mitigating errors due to incorrect recipient details. Verification of Payee API enables the transmission of payee information to the Payee’s Bank. Payee Bank can then respond with the Match/Close Match /No Match Result, which can help the payer to take an informed decision.

Key Features

1. Real-time Verification

2. Fraud Prevention

3. Regulatory Compliance

4. REST API Integration

5. White Labelling support

6. Multilanguage support

7. Results in JSON

Verification Of Payee APIs

API Name | API Endpoint | API Description |

|---|---|---|

Verification of Payee | POST /verify | API to initiate Verification of Payee. |

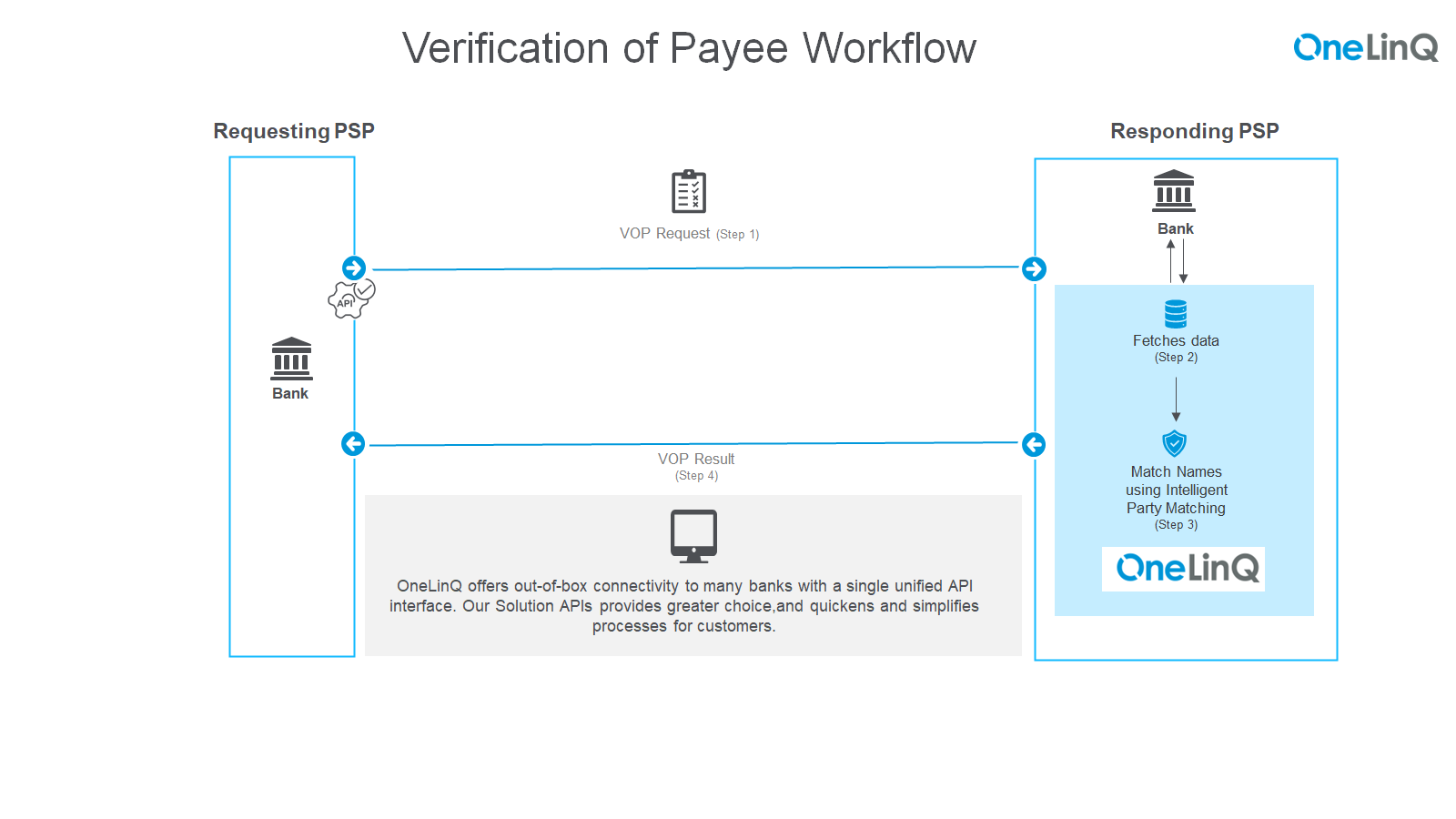

Verification Of Payee Flow Diagram

Verification Of Payee Steps

Step 1: Verification of Payee Request

Requesting PSP sends the VoP request to the Responding PSP. The request should contain inter-alia Payee details (Name, IBAN, optionally Identification Code and code type). On receiving the VoP request, OneLinQ will validate the request body.

Step 2: Fetch Account Data from Responding PSP

After API request validation, OneLinQ, using the IBAN, will fetch Payment Counterparty (Payee) details as appearing in the Responding PSP’s records.

Step 3: Intelligent Party Matching

On receiving the Payment Counterparty (Payee) details from the Responding PSP, OneLinQ will match the data received in the VoP request with the Payment Counterparty (Payee) information fetched from the Responding PSP using its Intelligent Party Matching (IPM) Algorithms and derive the result – Match/No Match/Close Match based on the Match Score.

The interpretation of Match Score vs Match Result is proposed as follows & is configurable as per calling PSP.

Matching Score | Matching Result |

|---|---|

0 to 70 | No Match |

71 to 95 | Close Match |

Above 95 | Match |

Step 4: Verification of Payee Response

OneLinQ will send the VoP response to the Requesting PSP with the appropriate Match Result (i.e. Match, Close Match with the Name of the Payment Counterparty as recorded with the responding PSP, No Match).