PSD2 AIS API

PSD2 AIS APIs

API Name | API Endpoint | API Description |

Account Access Consent | POST /account-access-consent | Creates an account access consent request, after which PSU approval needs to be taken on it using OAuth flow. |

Account Bulk | GET /accounts/summary | Returns list of accounts with the details |

Account Specific | GET /accounts/{AccountId}/summary | Returns details of a specific account |

Balance Bulk | GET /accounts/balances | Returns balance details of all the accounts |

Balance Specific | GET /accounts/{AccountId}/balances | Returns balance details of a specific account |

Transactions Bulk | GET /accounts/transactions | Returns list of transactions of all the accounts |

Transactions Specific | GET /accounts/{AccountId}/transactions | Returns list of transactions of a specific account |

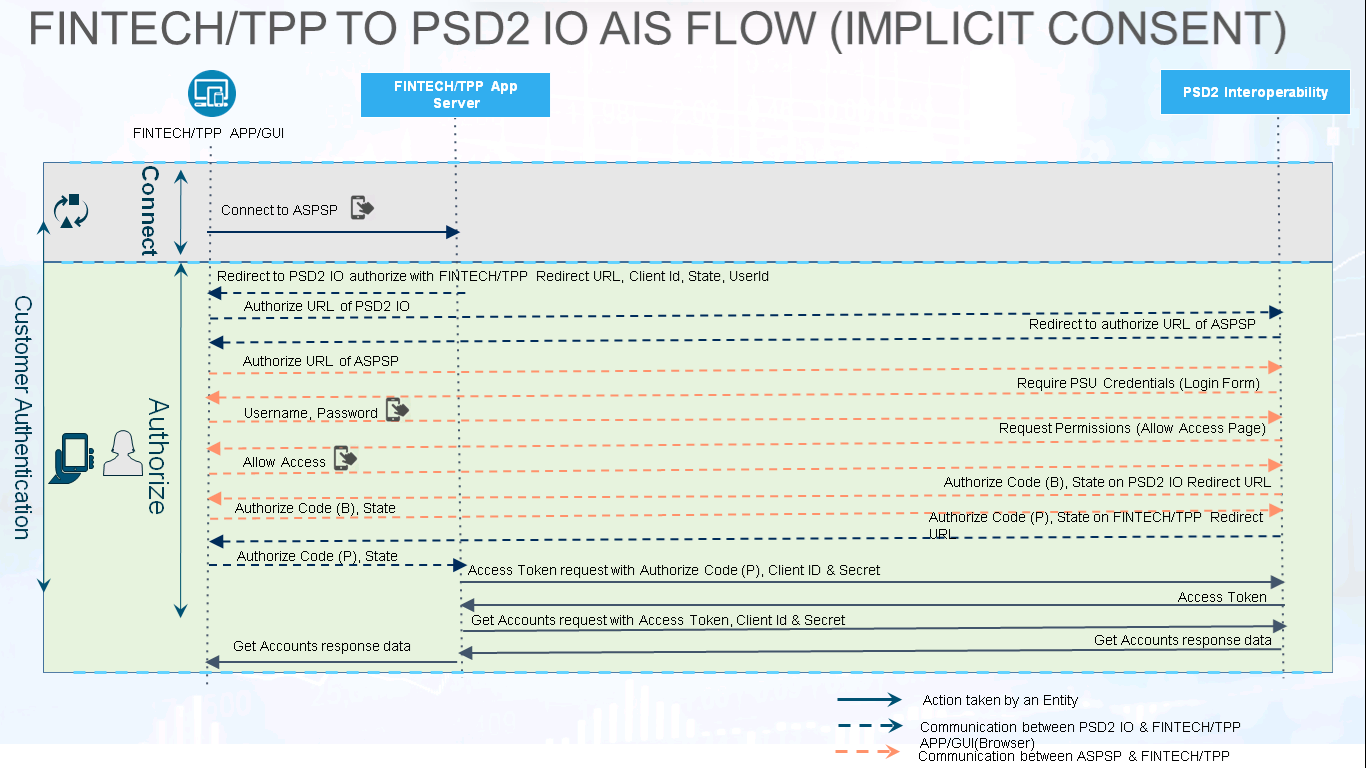

Implicit Consent

If GET /bank returns AisConsentType as IMPLICIT then implicit flow will be apllicatble.

Step 1: Authorize

- Fintech/TPP will redirect PSU to PSD2 IO ‘/authorize’ URL with Fintech/TPP Redirect URL, Client Id, State, UserId for authentication and authorization of PSU.

- PSU will get redirected to PSD2 IO authorize URL through browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of Fintech/TPP.

Step 2: Access Token

- Fintech/TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech/TPP.

Step 3: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

Explicit Consent - OAuth SCA

If GET /bank returns AisConsentType as EXPLICIT then explicit flow will be apllicatble.

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Authorize

- Fintech/TPP will redirect PSU to PSD2 IO ‘/authorize’ URL with TPP Redirect URL, Client Id, State, UserId for authentication and authorization of PSU.

- PSU will get redirected to PSD2 IO authorize URL through browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of TPP.

Step 4: Access Token

- Fintech/TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech/TPP.

Step 5: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

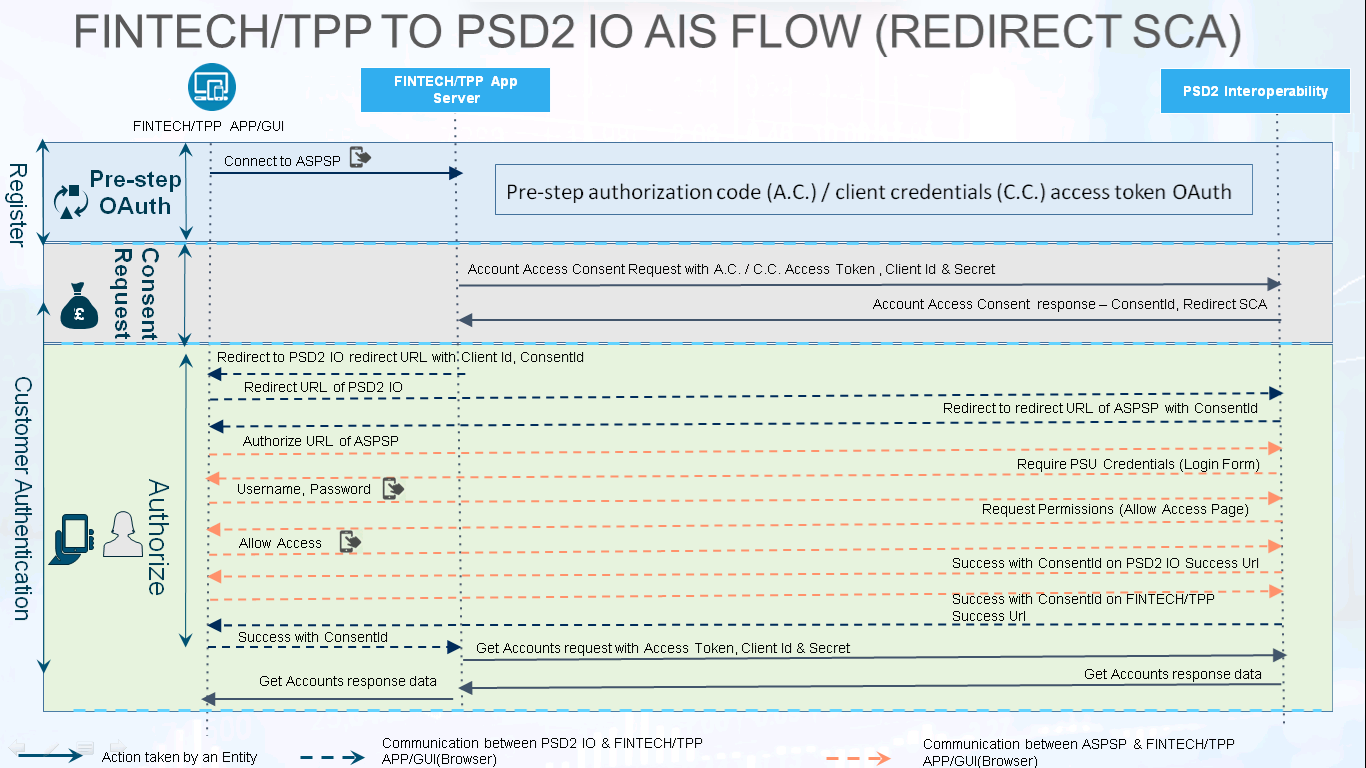

Explicit Consent - Redirect SCA

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Redirect

- Fintech/TPP will redirect PSU to ‘/redirect’ URL with Client Id, ConsentId to authenticate the ConsentId from PSU.

- PSU will get redirected to PSD2 IO redirect URL through browser.

- PSD2 IO will redirect PSU to ASPSP redirect URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return success along with ConsentId on the success URL of PSD2 IO.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 4: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

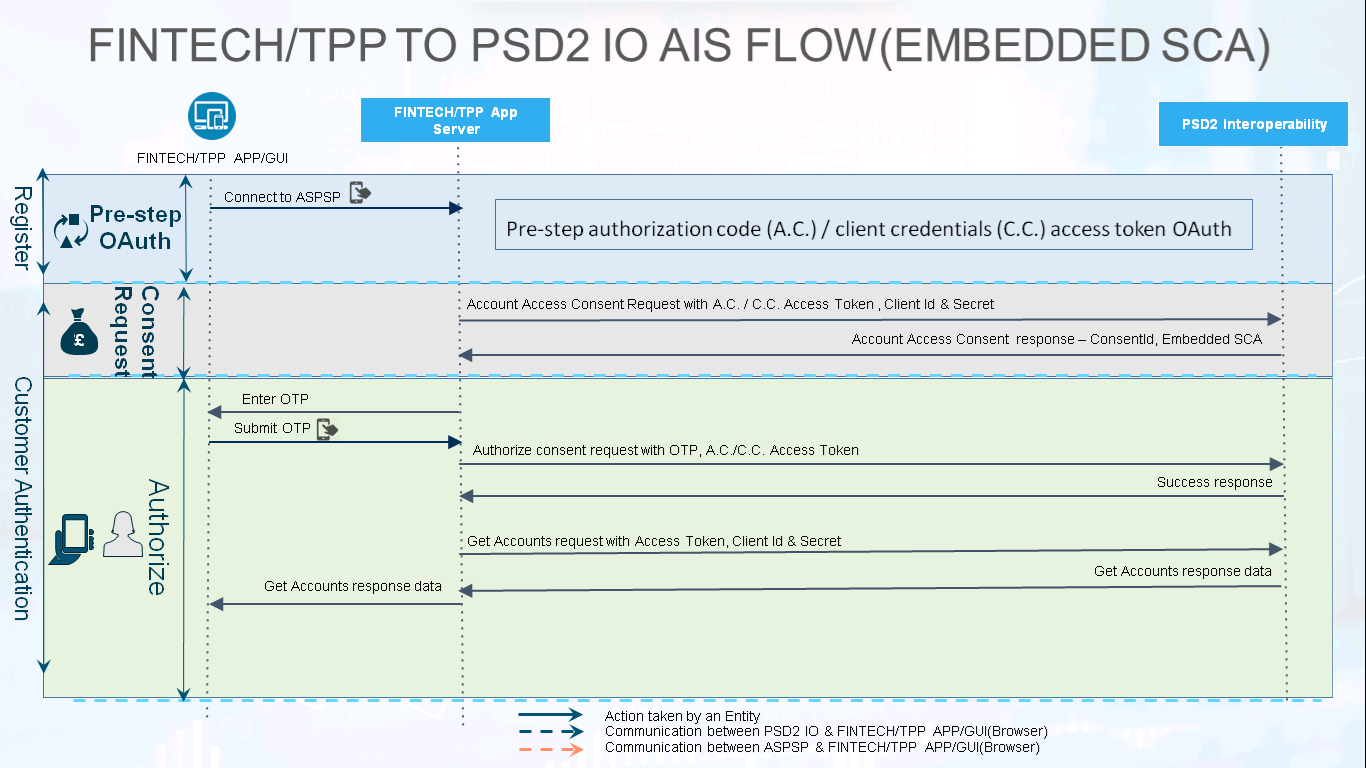

Explicit Consent - Embedded SCA

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Embedded SCA

- Fintech/TPP will ask PSU to provide answer of the challenge received in the account access consent response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize consent API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

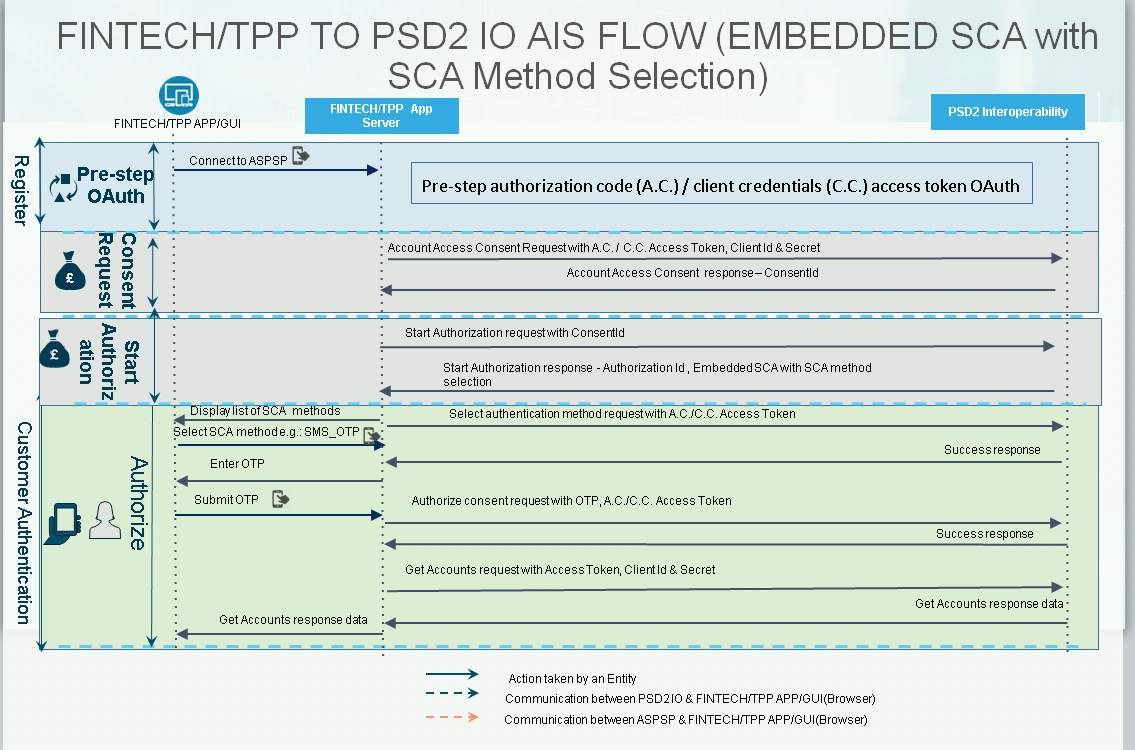

Explicit Consent - Embedded SCA with SCA Method Selection

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId with a link to initiate consent authorization.

Step 3: Start Authorization

- Fintech/TPP will send the start Authorization request with ConsentId to PSD2 IO.

- PSD2 IO will return response containing AuthorizationId with SCA method selection to Fintech/TPP.

Step 4: Embedded SCA with SCA Method Selection

- Fintech/TPP Fintech/TPP will ask PSU to select SCA method out of those received in the response.

- PSU will select the SCA method.

- Fintech/TPP will call select authentication API using the A.C./C.C. access token and selected SCA method.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will ask PSU to provide answer of the challenge received in the select authentication API response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize consent API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on TPP UI.

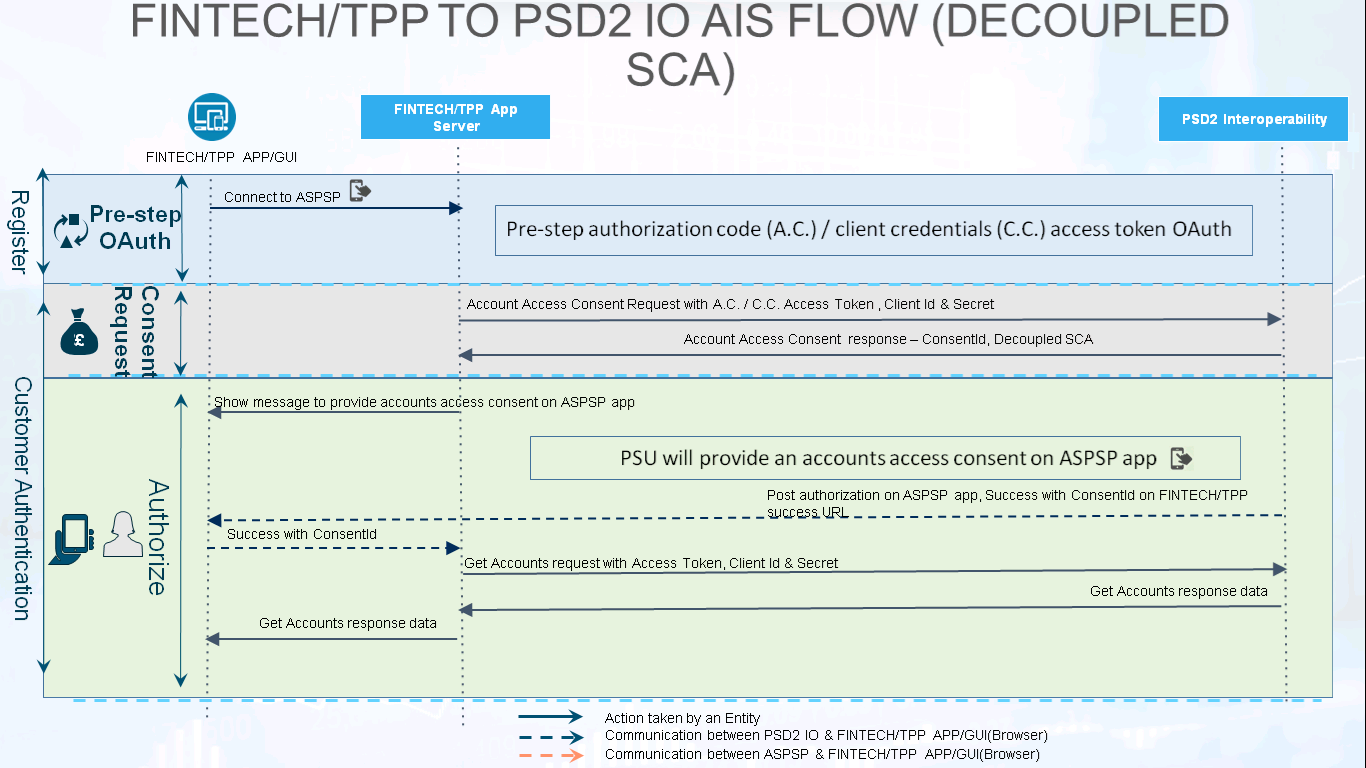

Explicit Consent - Decoupled SCA

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Provide accounts access consent on ASPSP application

- Fintech/TPP will show the message to PSU to provide an accounts access consent on ASPSP application.

- PSU will provide an accounts access consent on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 4: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

Explicit Consent - Decoupled SCA with Update Identification

Step 1: Pre-step OAuth

- PSU will request to fetch accounts from ASPSP.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the account access consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Decoupled SCA with Update Identification

- PP will ask PSU to update his identification data.

- PSU will enter his identification data e.g. PSU-Id.

- Fintech/TPP will call update identification API with the PSU identification data, C.C. access token

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Provide accounts access consent on ASPSP application

- Fintech/TPP will show the message to PSU to provide an accounts access consent on ASPSP application.

- PSU will provide an accounts access consent on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 5: Get Accounts/Balances/Transactions

- Fintech/TPP will call get ‘/accounts’ API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.