PSD2 FC API

PSD2 FC APIs

API Name | API Endpoint | API Description |

Fund Confirmation Consent | POST /funds-confirmation-consents | Creates a fund confirmation consent |

Get Fund Confirmation Consent | GET /funds-confirmation-consents/{ConsentId} | Get fund confirmation consent details |

Revoke Fund Confirmation Consent | DELETE /funds-confirmation-consents/{ConsentId} | Revoke fund confirmation consent |

Fund Confirmations | POST /funds-confirmations | Fund confirmation |

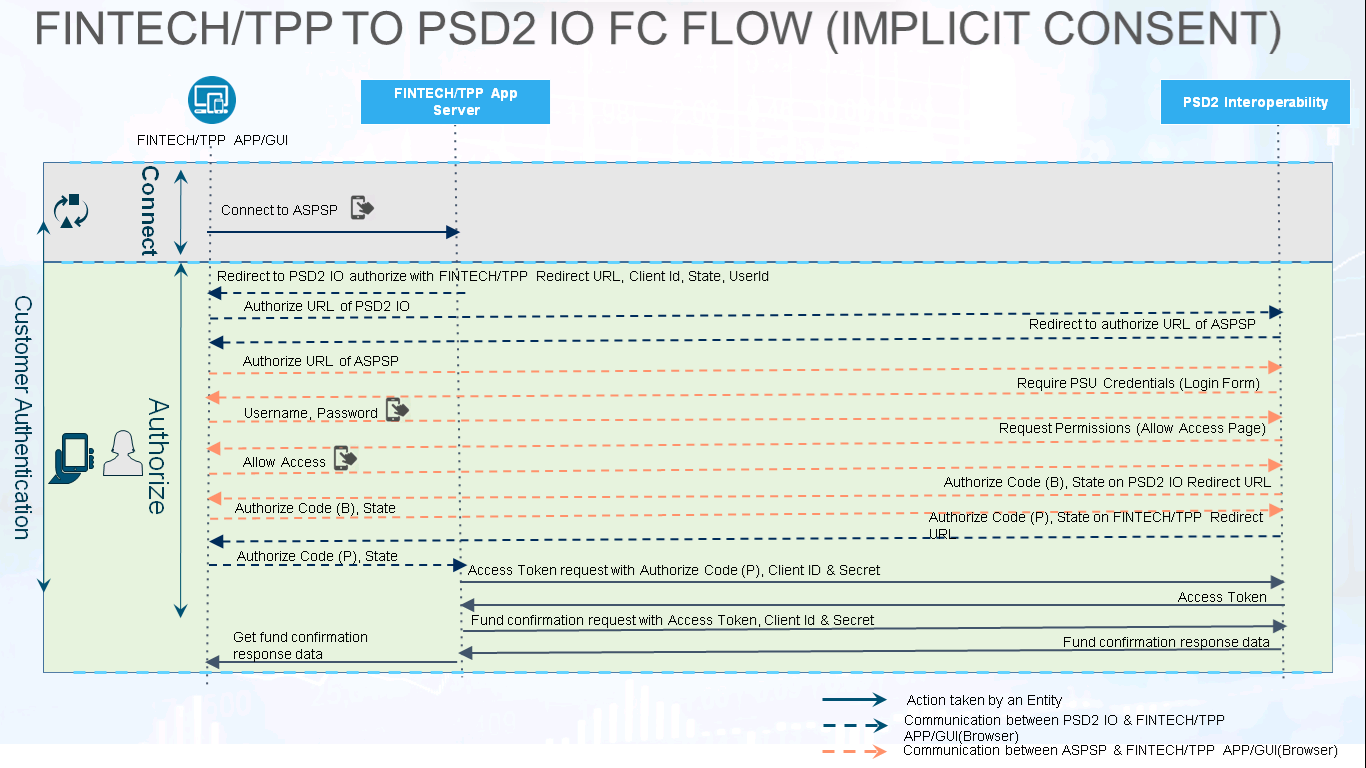

Implicit Consent

If GET /bank returns AisConsentType as IMPLICIT then implicit flow will be apllicatble.

Step 1: Authorize

- Fintech/TPP will redirect PSU to PSD2 IO ‘/authorize’ URL with Fintech/TPP Redirect URL, Client Id, State, UserId for authentication and authorization of PSU.

- PSU will get redirected to PSD2 IO authorize URL through browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of Fintech/TPP.

Step 2: Access Token

- Fintech/TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech/TPP.

Step 3: Get Fund Confirmation

- Fintech/TPP will call get fund confirmation API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

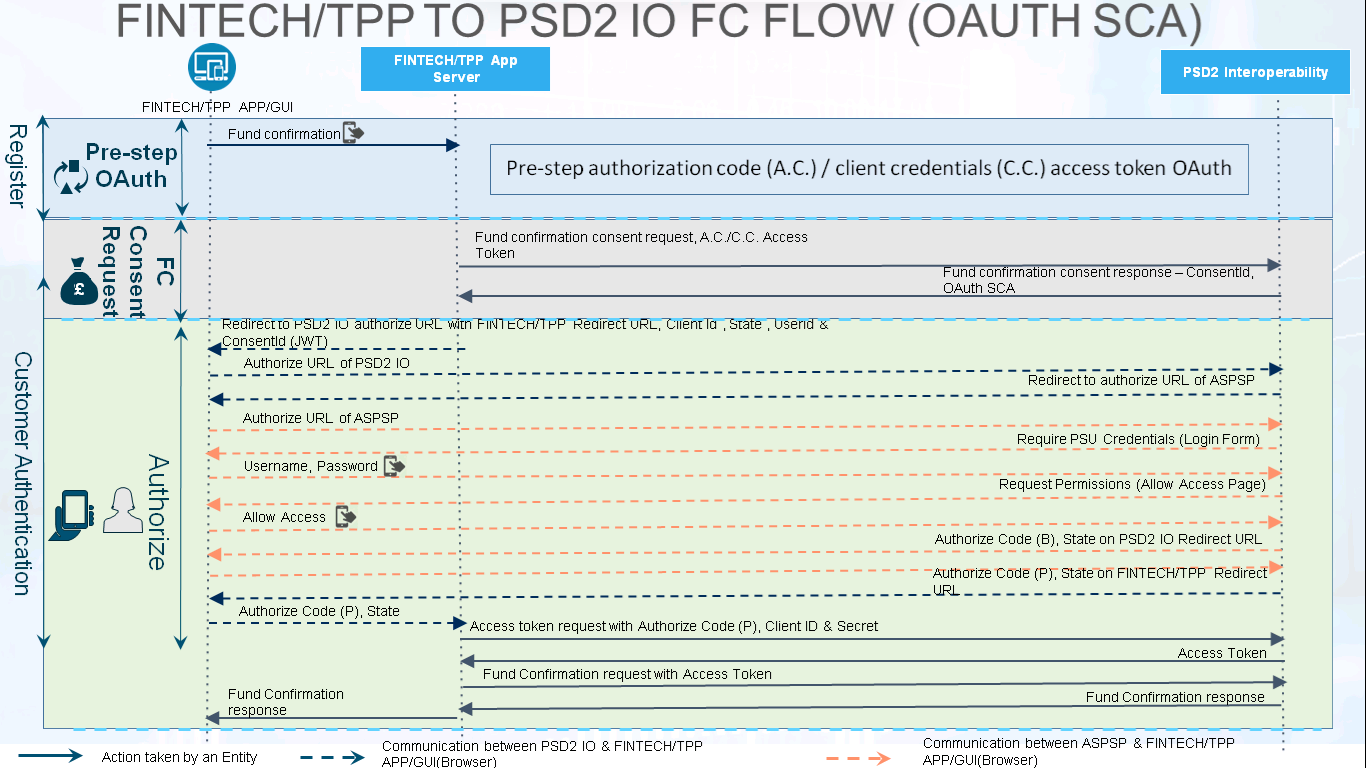

Explicit Consent - OAuth SCA

If GET /bank returns AisConsentType as EXPLICIT then explicit flow will be apllicatble.

Step 1: Pre-step OAuth

- PSU will request for confirmation of fund.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the fund confirmation consent request with A.C/C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Authorize

- Fintech/TPP will redirect PSU to ‘/authorize’ URL with Fintech/TPP Redirect URL, Client Id , State , UserId & ConsentId in JWT to authenticate the request id from PSU.

- PSU will get redirected to PSD2 IO authorize URL through browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of Fintech/TPP.

Step 4: Access Token

- Fintech/TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech/TPP.

Step 5: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

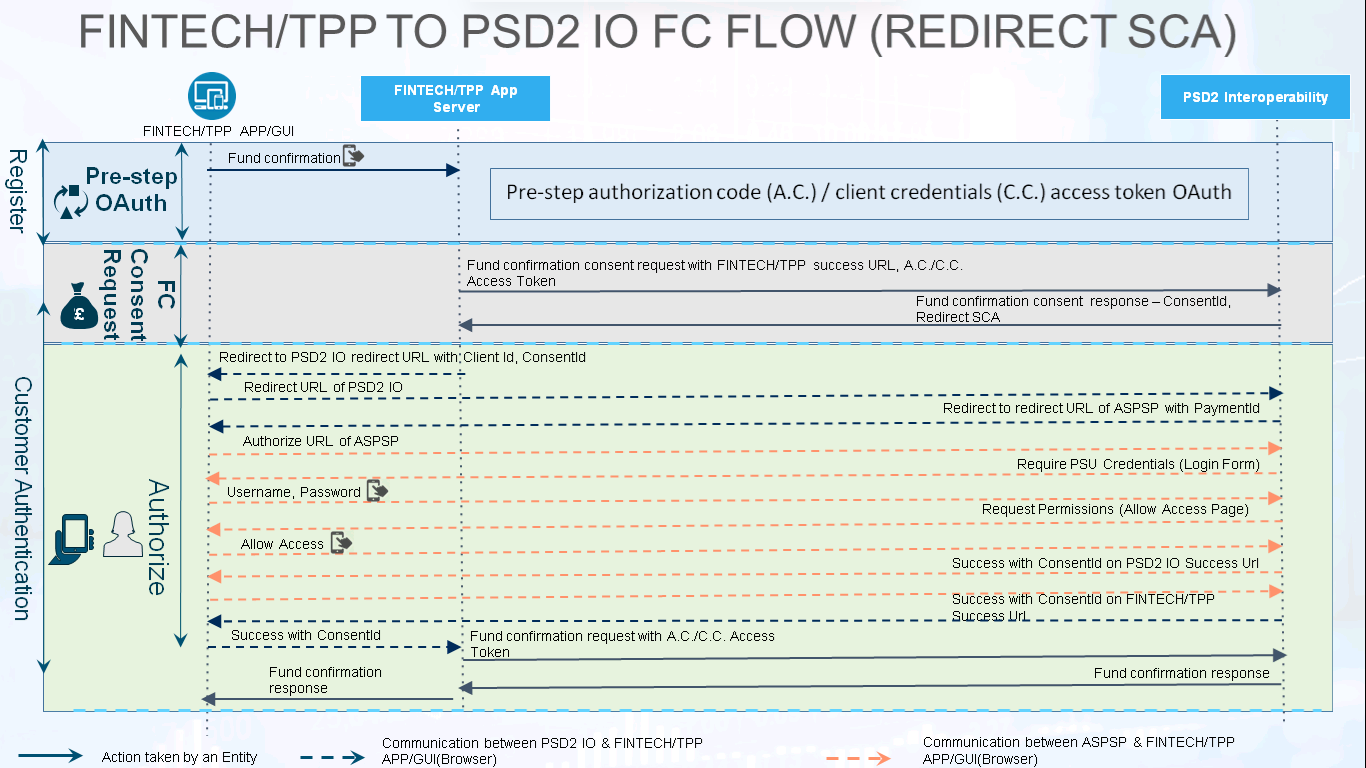

Explicit Consent - Redirect SCA

Step 1: Pre-step OAuth

- PSU will request for confirmation of fund.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the fund confirmation consent request with TPP success URL, A.C./C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, Redirect SCA approach to Fintech/TPP.

Step 3: Redirect

- Fintech/TPP will redirect PSU to ‘/redirect’ URL with Client Id, ConsentId to authenticate the ConsentId from PSU.

- PSU will get redirected to PSD2 IO redirect URL through browser.

- PSD2 IO will redirect PSU to ASPSP redirect URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return success along with ConsentId on the success URL of PSD2 IO.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 4: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the A.C./C.C. access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

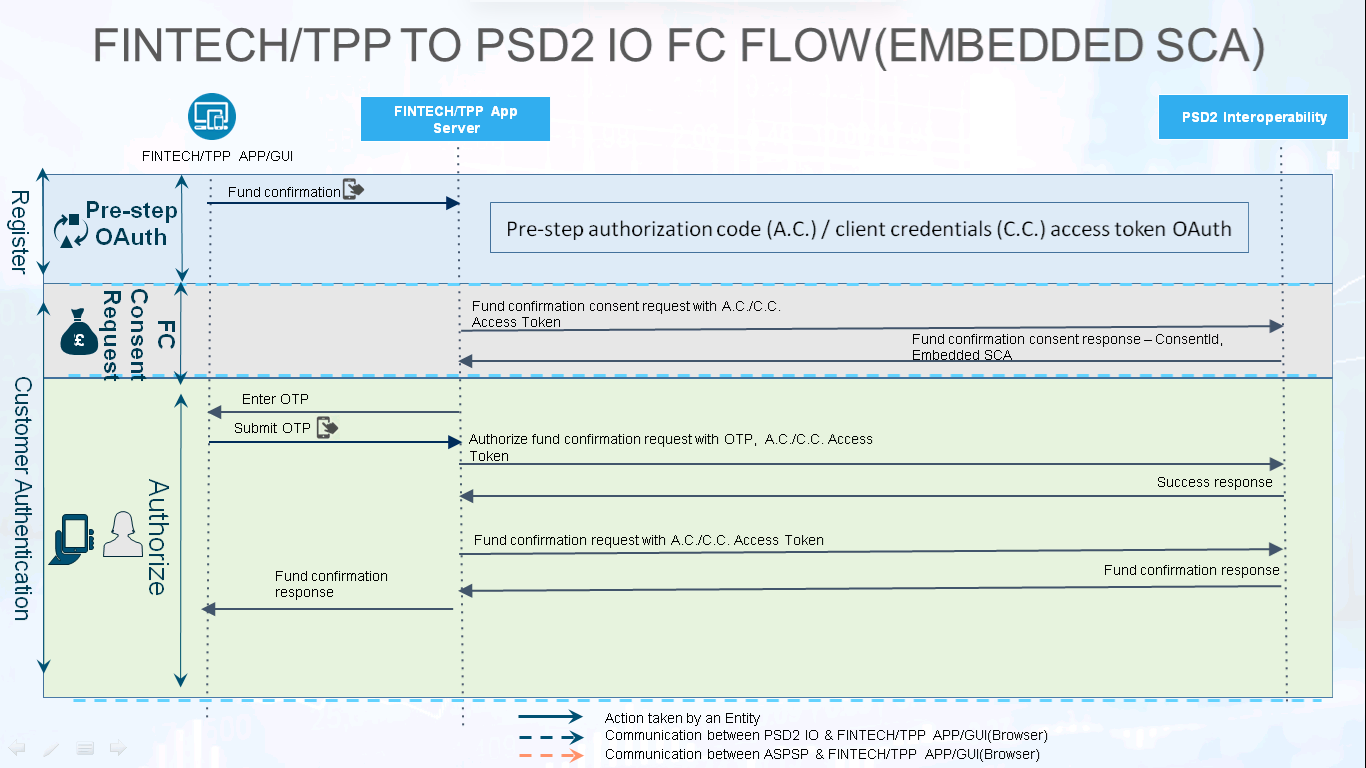

Explicit Consent - Embedded SCA

Step 1: Pre-step OAuth

- PSU will request for confirmation of fund.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Embedded SCA

- Fintech/TPP will ask PSU to provide answer of the challenge received in the payment create response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize fund confirmation API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the A.C./C.C. access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

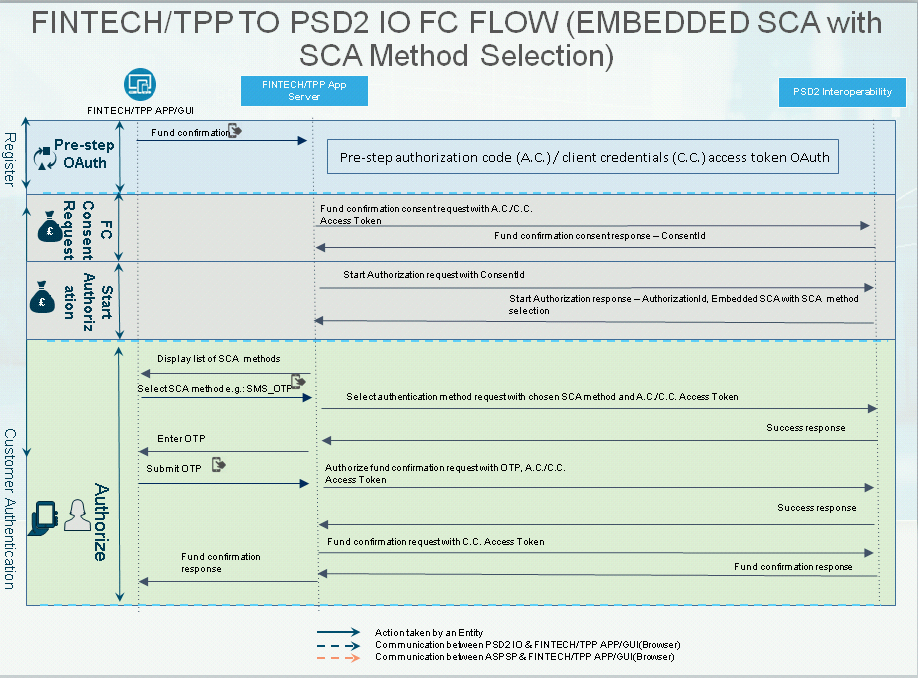

Explicit Consent - Embedded SCA with SCA Method Selection

Step 1: Pre-step OAuth

- PSU will request for confirmation of fund.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Start Authorization

- Fintech/TPP will send the start Authorization request with ConsentId to PSD2 IO.

- PSD2 IO will return response containing AuthorizationId with SCA method selection to Fintech/TPP.

Step 4: Embedded SCA with SCA Method Selection

- Fintech/TPP will ask PSU to select SCA method out of those received in the response.

- PSU will select the SCA method.

- Fintech/TPP will call select authentication API using the A.C./C.C. access token and selected SCA method.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will ask PSU to provide answer of the challenge received in the select authentication API response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize payment API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the A.C./C.C. access token.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

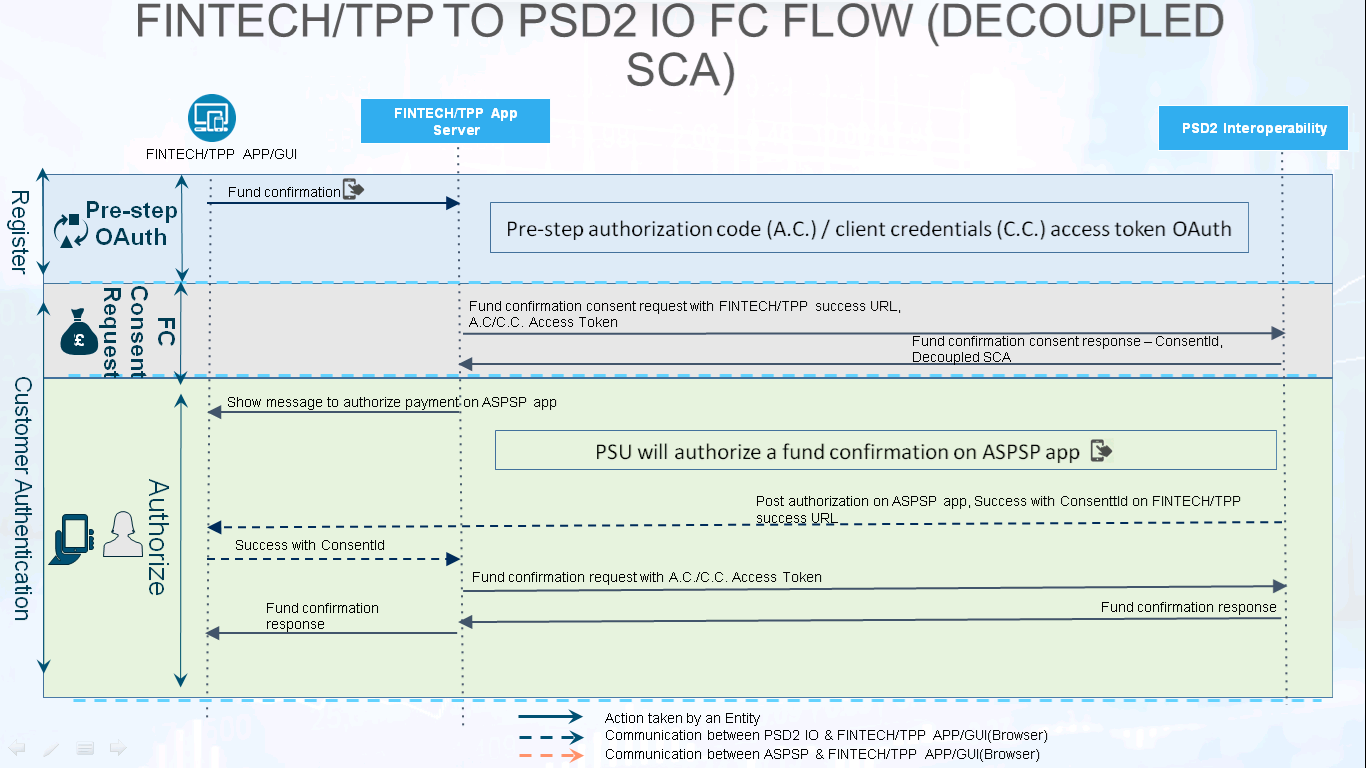

Explicit Consent - Decoupled SCA

Step 1: Pre-step OAuth

- PSU will request for confirmation of fund.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the fund confirmation consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Authorize payment on ASPSP application

- Fintech/TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 4: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

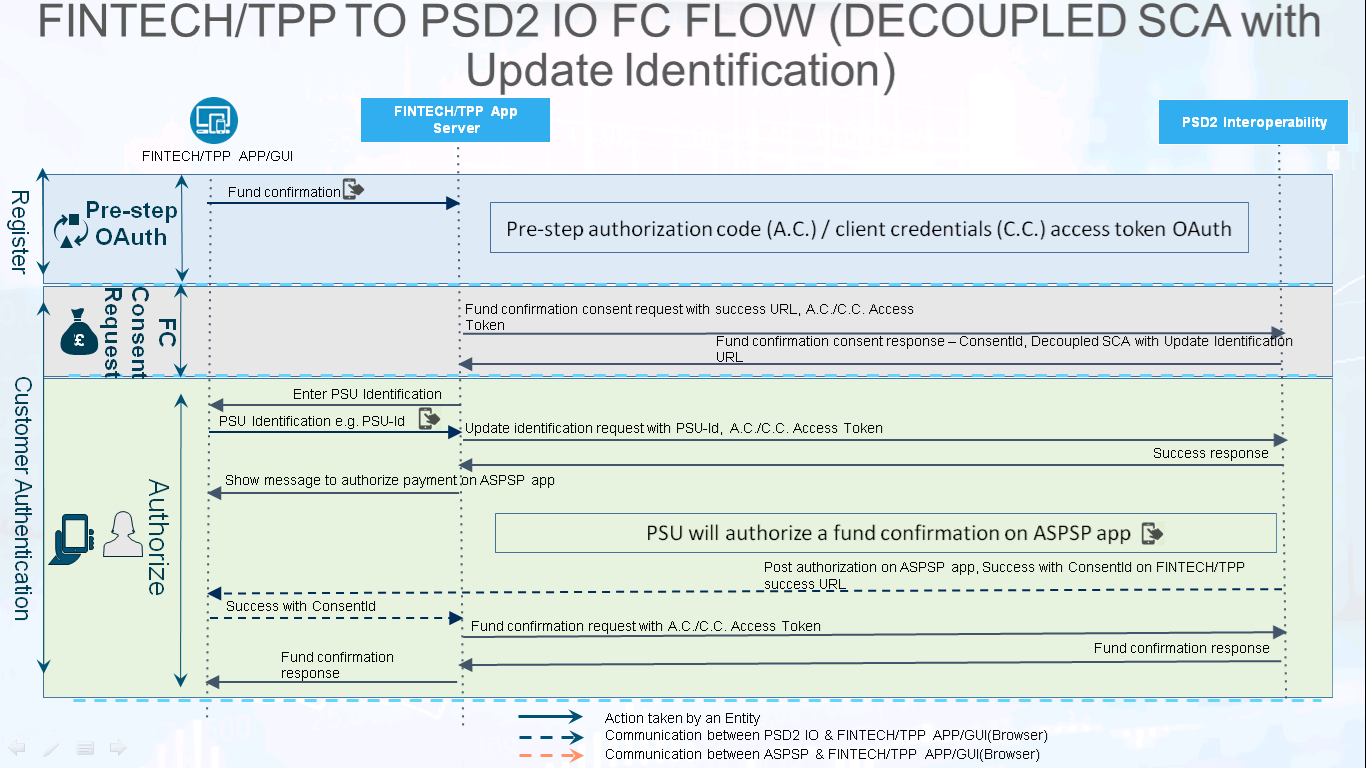

Explicit Consent - Decoupled SCA with Update Identification

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Fund Confirmation Consent

- Fintech/TPP will send the fund confirmation consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech/TPP.

Step 3: Decoupled SCA with Update Identification

- PP will ask PSU to update his identification data.

- PSU will enter his identification data e.g. PSU-Id.

- Fintech/TPP will call update identification API with the PSU identification data, C.C. access token

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Authorize fund confirmation on ASPSP application

- Fintech/TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech/TPP.

Step 5: Fund Confirmation

- Fintech/TPP will call fund confirmation API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.