OBWG PSD2 PIS

OBWG PSD2 PIS APIs

API Name | API Endpoint | API Description |

Domestic Payment Create | POST /domestic-payment-consents | Create domestic payment consents |

Domestic Payment Submit | POST /domestic-payments | Submits a created domestic payment |

Domestic Payment Detail | GET /domestic-payment-consents/{ConsentId} | Returns the details of created domestic payment |

Domestic Payment Create Status | GET /domestic-payment-consents/{ConsentId}/status | Returns the status of created domestic payment |

Domestic Payment Submit Details | GET /domestic-payments/{DomesticPaymentId} | Returns the details of a submitted domestic payment |

Domestic Payment Submit Status | GET /domestic-payments/{DomesticPaymentId}/status | Returns the status of a submitted domestic payment |

Domestic Scheduled Payment Create | POST /domestic-scheduled-payment-consents | Create domestic dcheduled payment consents |

Domestic Scheduled Payment Submit | POST /domestic-scheduled-payments | Submits a created domestic scheduled payment |

Domestic Scheduled Payment Details | GET /domestic-scheduled-payment-consents/{ConsentId} | Returns the details of created domestic scheduled payment |

Domestic Scheduled Payment status | GET /domestic-scheduled-payment-consents/{ConsentId}/status | Returns the status of created domestic scheduled payment |

Domestic Scheduled Payment Submit Details | GET /domestic-scheduled-payments/{DomesticScheduledPaymentId} | Returns the details of a submitted domestic scheduled payment |

Domestic Scheduled Payment Submit Status | GET /domestic-scheduled-payments/{DomesticScheduledPaymentId}/status | Returns the status of a submitted domestic scheduled payment |

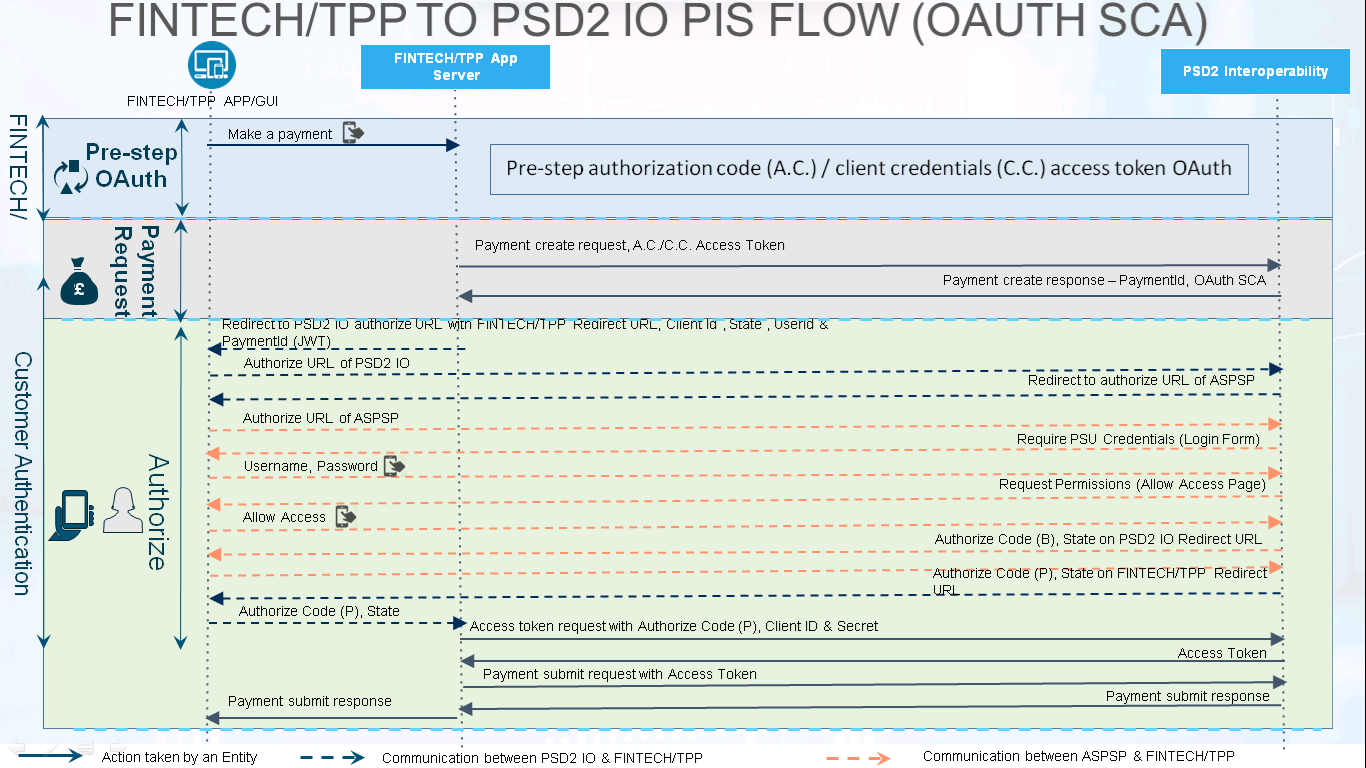

OAuth SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment-Consent

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech / TPP.

Step 3: Authorize

- Fintech / TPP will redirect PSU to ‘/authorize’ URL with TPP Redirect URL,Client Id, State, UserId & ConsentId in JWT to authenticate the request id from PSU.

- PSU will get redirected to PSD2 IO authorize URL through the browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through the browser.

- ASPSP will redirect PSU to the login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of Fintech / TPP.

Step 4: Access Token

- Fintech / TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech / TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the access token received.

- PSD2 IO will give the response to Fintech / TPP.

- Fintech / TPP will show the response to PSU on TPP UI.

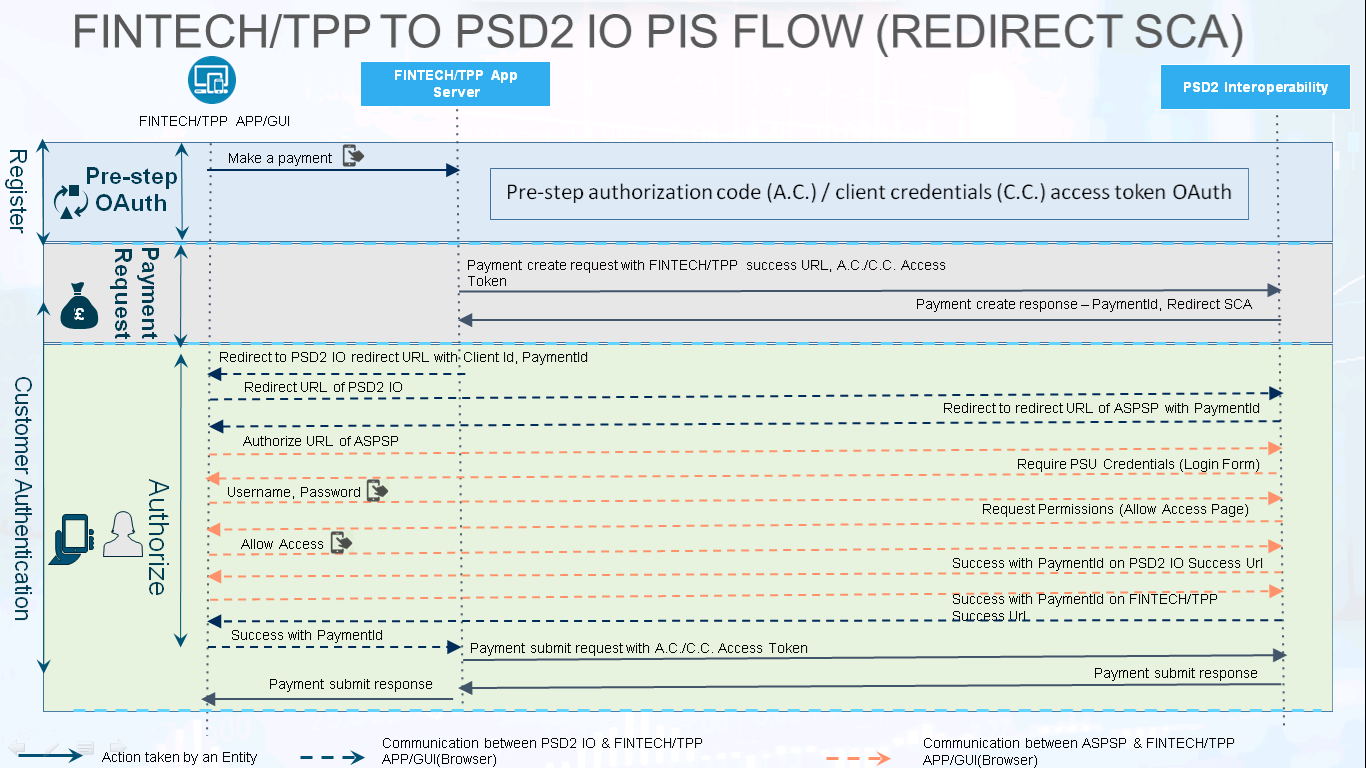

Redirect SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment-Consent

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech / TPP.

Step 3: Redirect

- Fintech / TPP will redirect PSU to ‘/redirect’ URL with Client Id, ConsentId to authenticate the ConsentId from PSU.

- PSU will get redirected to PSD2 IO redirect URL through browser.

- PSD2 IO will redirect PSU to ASPSP redirect URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return success along with ConsentId on the success URL of PSD2 IO.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech / TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech / TPP.

- Fintech / TPP will show the response to PSU on TPP UI.

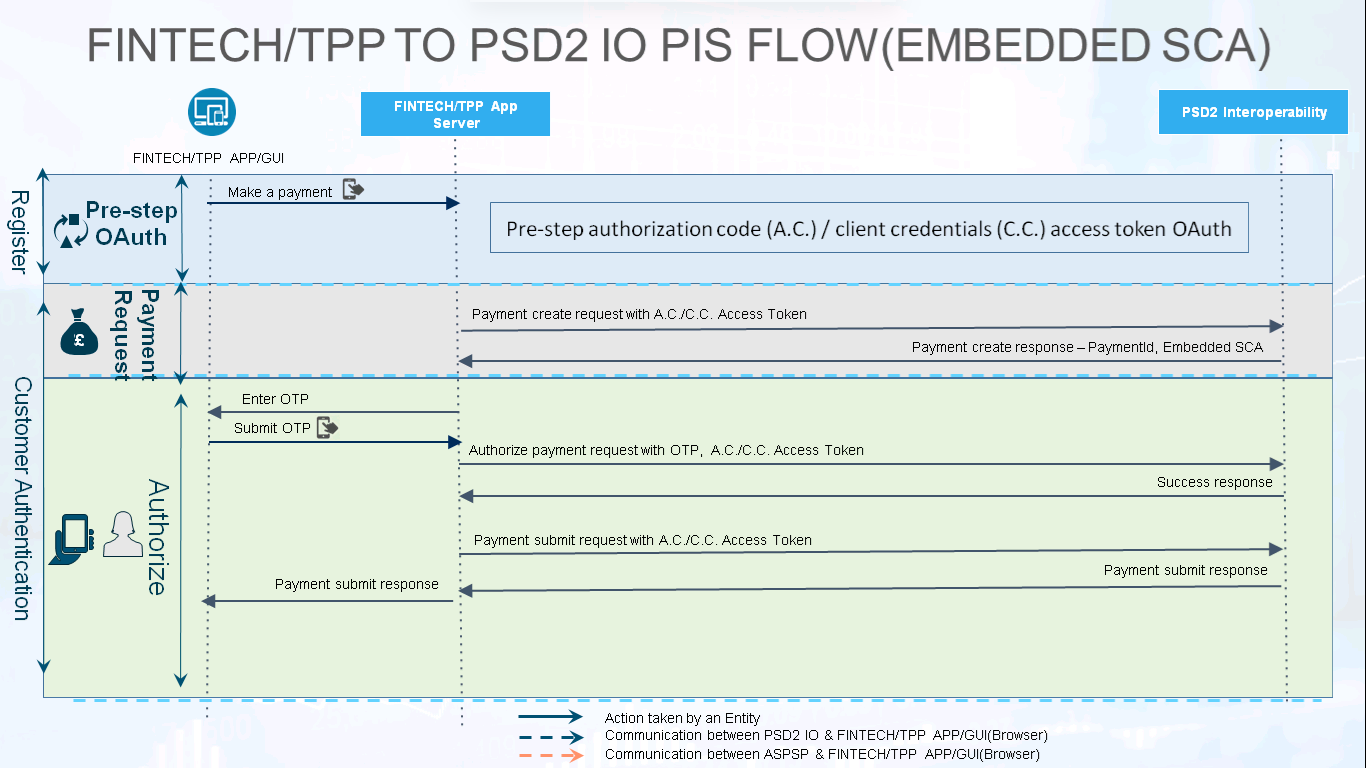

Embedded SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment-Consent

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to TPP.

Step 3: Embedded SCA

- Fintech / TPP will ask PSU to provide answer of the challenge received in the payment create response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- TPP will call authorize payment API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech / TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to TPP.

- Fintech / TPP will show the response to PSU on Fintech / TPP UI.

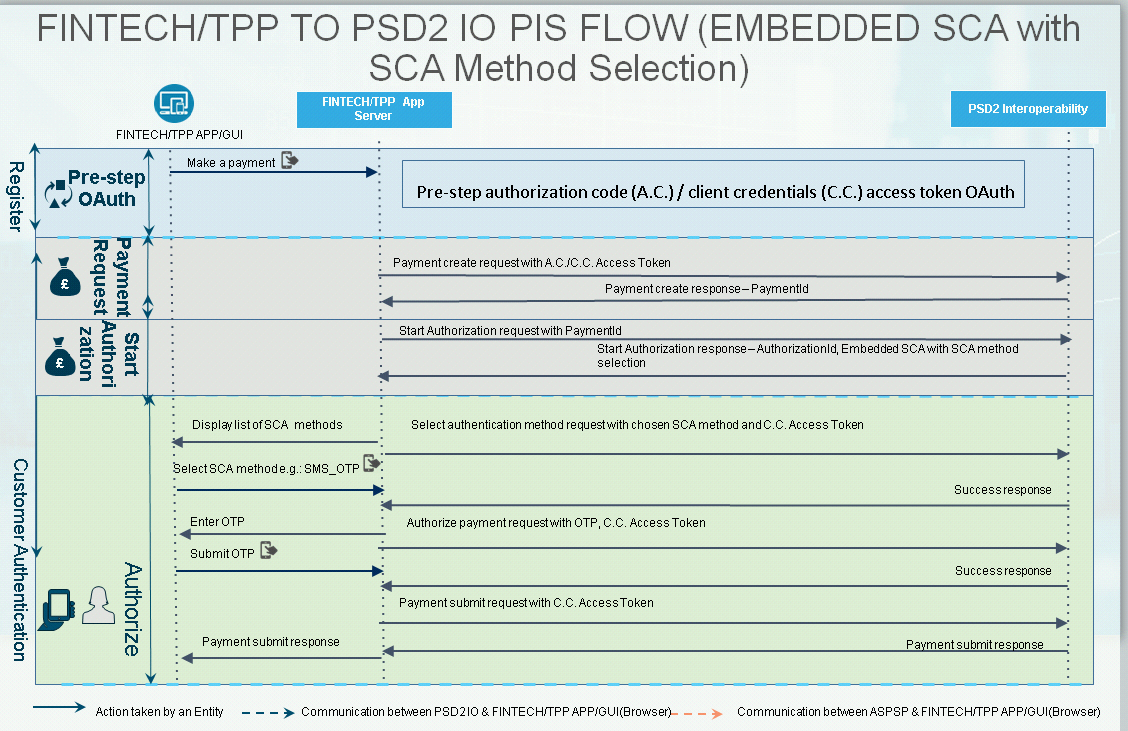

Embedded SCA with SCA Method Selection

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment-Consent

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech / TPP.

Step 3: Start Authorization

- Fintech/TPP will send the start Authorization request with ConsentId to PSD2 IO.

- PSD2 IO will return response containing AuthorizationId with SCA method selection to Fintech/TPP.

Step 4: Embedded SCA with SCA Method Selection

- Fintech / TPP will ask PSU to select SCA method out of those received in the response.

- PSU will select the SCA method.

- Fintech / TPP will call select authentication API using the A.C./C.C. access token and selected SCA method.

- PSD2 IO will give the response to Fintech / TPP.

- Fintech / TPP will ask PSU to provide answer of the challenge received in the select authentication API response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech / TPP will call authorize payment API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to TPP.

- Fintech / TPP will show the response to PSU on TPP UI.

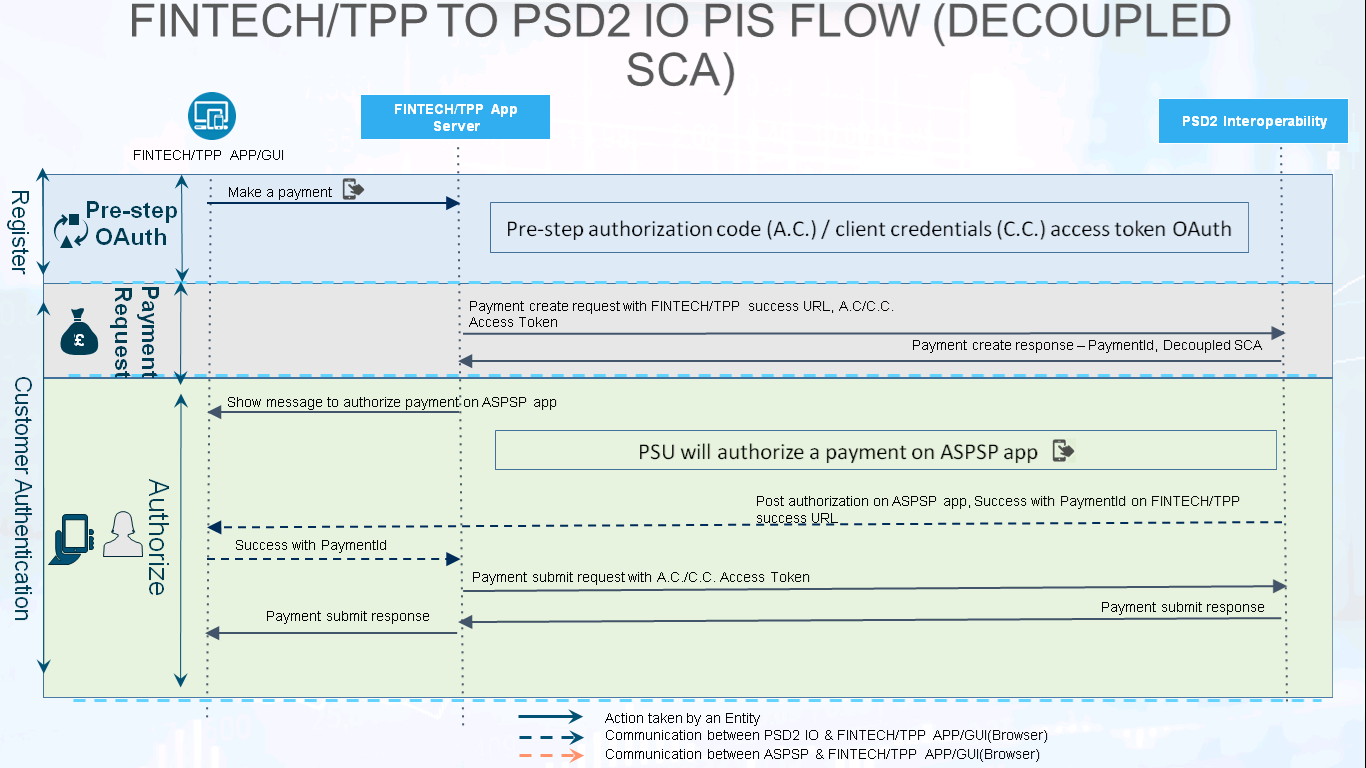

Decoupled SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment-Consent

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing consentId, OAuth SCA approach to Fintech / TPP.

Step 3: Authorize payment on ASPSP application

- Fintech / TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech / TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech / TPP.

- Fintech / TPP will show the response to PSU on Fintech / TPP UI.

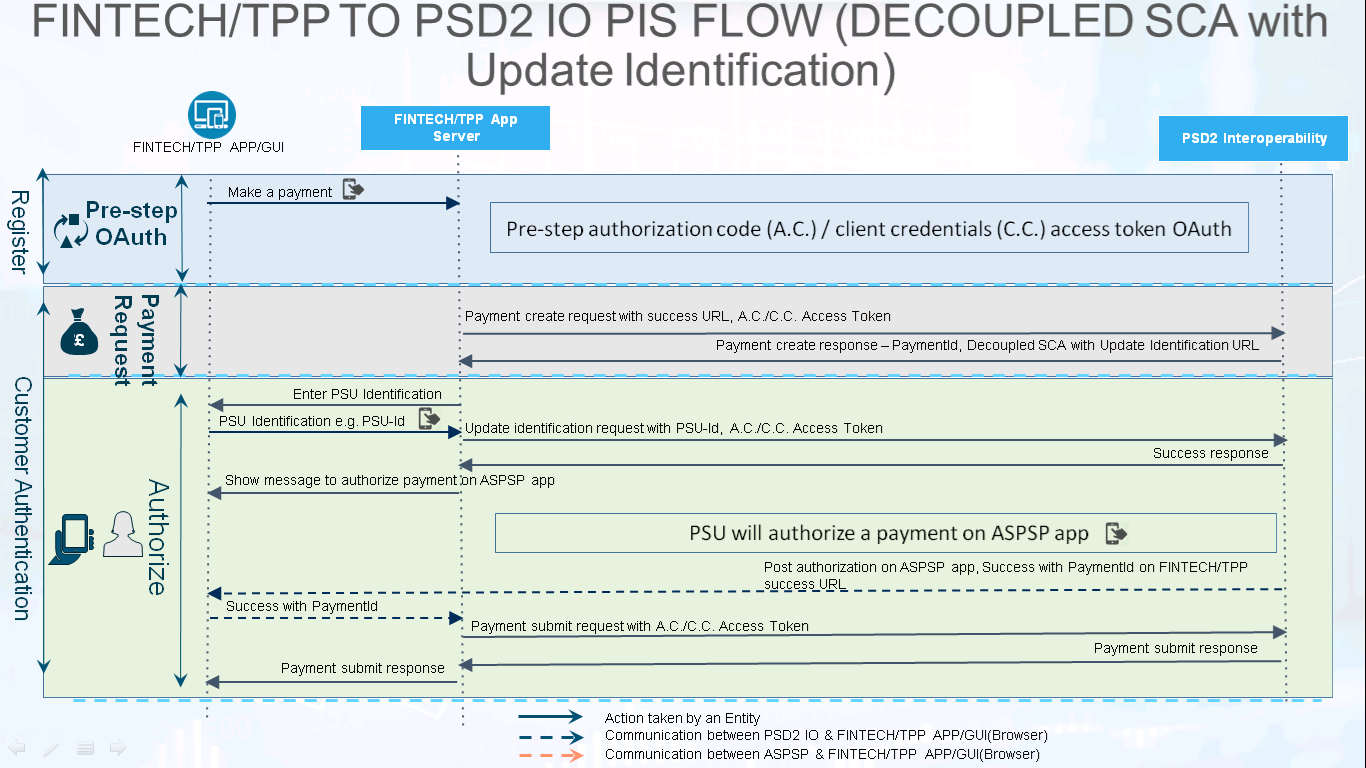

Decoupled SCA with Update Identification

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech / TPP will send the payment-consent request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing ConsentId, OAuth SCA approach to Fintech / TPP.

Step 3: Decoupled SCA with Update Identification

- PP will ask PSU to update his identification data.

- PSU will enter his identification data e.g. PSU-Id.

- Fintech / TPP will call update identification API with the PSU identification data, C.C. access token

- PSD2 IO will give the response to Fintech / TPP.

Step 4: Authorize payment on ASPSP application

- Fintech / TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with ConsentId on the success URL of Fintech / TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech / TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech / TPP.

- Fintech / TPP will show the response to PSU on Fintech / TPP UI.