Single Payment

Summary

OneLinQ Single Payment API facilitates Customers to make instant payments (Pay by Bank Via Open Banking Rail). Single Payment solution uses Open Banking/Faster Payment/SEPA Instant payment or equivalent real-time payment rail to enable the online transfers and inform the Customer instantly of the payment initiation.

Key Features

1. Secure data access

2. Real-time Payment Transfer

3. Alternative for cash-on-delivery and point-of-sale payments

4. Instant Notification of Payment Initiation

5. Results in JSON/PDF

6. Compliance with regulations

7. REST API Integration

8. White Labelling support

9. Multilanguage support

Single Payment APIs

API Name | API Endpoint | API Description |

Payment Initiation Request | POST /createPayment | API to initiate creating the single payment request. |

Payment Status | GET /paymentStatus/{paymentId} | API to get the status of the specific payment ID. |

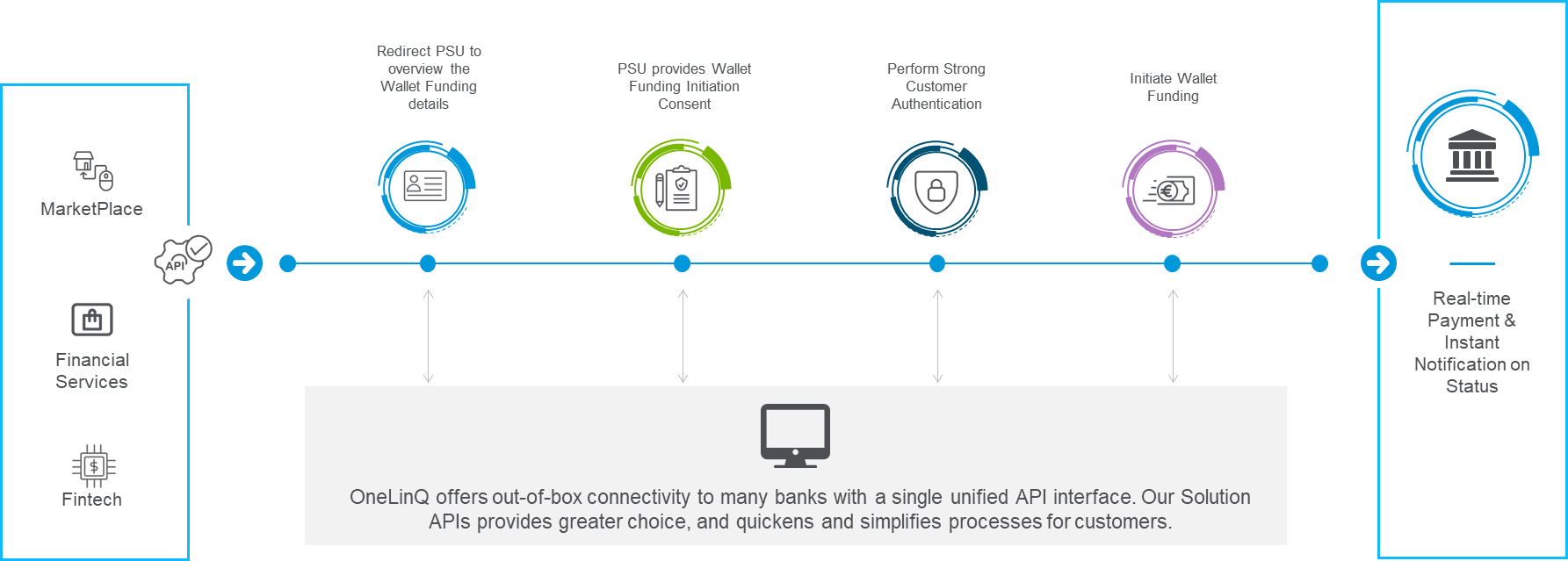

Single Payment Flow Diagram

Single payment API Steps

Step 1: Single Payment Request

The customer initiates the single payment request to the OneLinQ solution by calling create payment API with Payer, Payee & Payment information.

Step 2: Redirect Payment Request

Customers will be redirected to the Hosted Payments Page (HPP) to review the payment details.

Step 3: Payment Initiation Consent

The customer can review the payment details, provide consent, and confirm to proceed further or deny the payment.

Step 4: Initiate Payment

OneLinQ will use the PSD2 API interface of the nominated Customer bank to initiate the payment.

Step 5: Strong Customer Authentication

In case if the Customer bank asks for SCA then OneLinQ will support all the possible three options of Authentication viz. Embedded (Default), Re-directed, De-coupled.

Step 6: Execute the Payment

The bank will execute the payment and send the money to the payee’s account after it is successfully authorized by the Customer.

Step 7: Payment Confirmation

OneLinQ displays a confirmation page with the status of the request. In the case where the status of the payment is “pending” then OneLinQ will keep polling the status from the Customer bank till the final status is received. The Customer can fetch the status from the status API or use the Payment Webhook API which notifies the Customer about the current status.